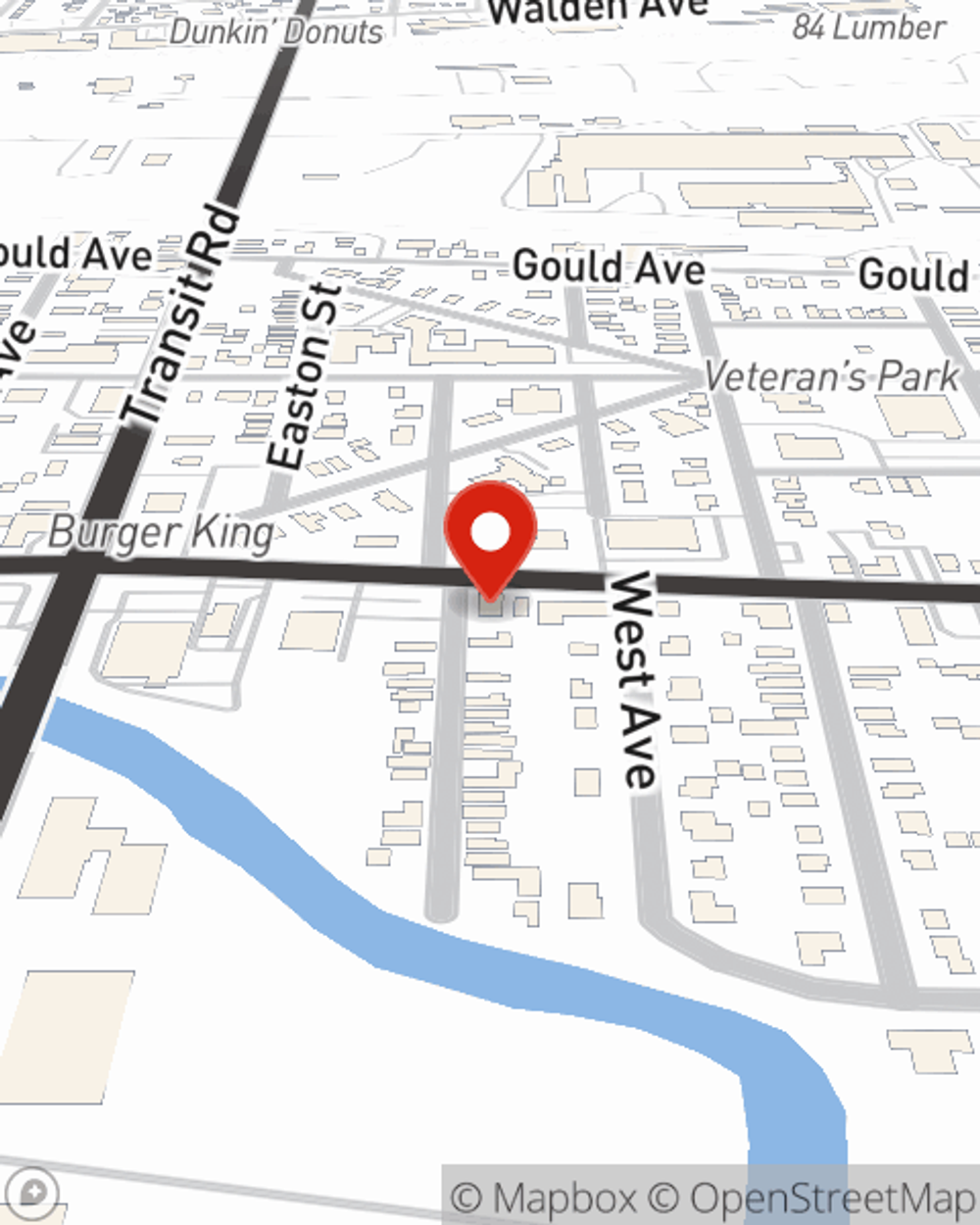

Business Insurance in and around Depew

Looking for small business insurance coverage?

No funny business here

State Farm Understands Small Businesses.

Running a business is about more than being your own boss. It’s a lifestyle and a way of life. It's a commitment to a bright future for you and for those you love. Because you do whatever it takes to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with errors and omissions liability, extra liability coverage and business continuity plans.

Looking for small business insurance coverage?

No funny business here

Customizable Coverage For Your Business

Your company is unique. It's where you make your living and also how you make a life—for yourself but also for your loved ones, and those who work for you. It’s more than just a shop or an office. Your business is an extension of yourself. Doing what you can to keep it safe just makes sense! A next great step is to get outstanding small business insurance from State Farm. Small business insurance covers a variety of occupations like a podiatrist. State Farm agent Joe Czaja is ready to help review coverages that fit your business needs. Whether you are a plumber, an electrician or a psychologist, or your business is an art store, a dental lab or a refreshment stand. Whatever your do, your State Farm agent can help because our agents are business owners too! Joe Czaja understands the unique needs you have and is ready to review coverages that meet your needs. With State Farm, you’ll be ready to grow your business into a bright future.

Reach out agent Joe Czaja to review your small business coverage options today.

Simple Insights®

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Joe Czaja

State Farm® Insurance AgentSimple Insights®

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.